MAUs, Revenue, Q4 Projections, and More Takeaways from Spotify’s Q3 Run

In Q3 2023, Spotify reached 226 million paying users, resulting in approximately $3.16 billion in Premium revenue, a YoY increase of 16%

Last week, Spotify shared interesting insights as it disclosed its financial results and user numbers for Q3 2023, which ended on September 30.

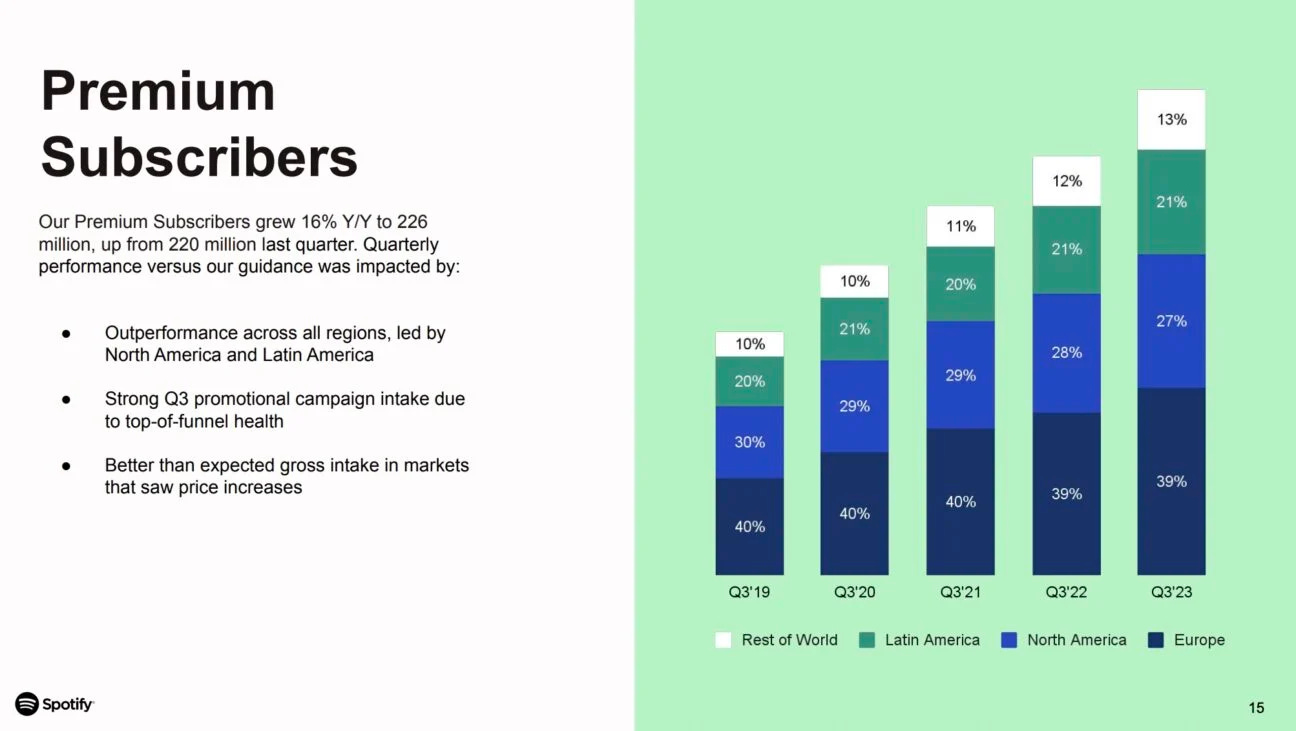

Paying Subscriber Count (Premium)

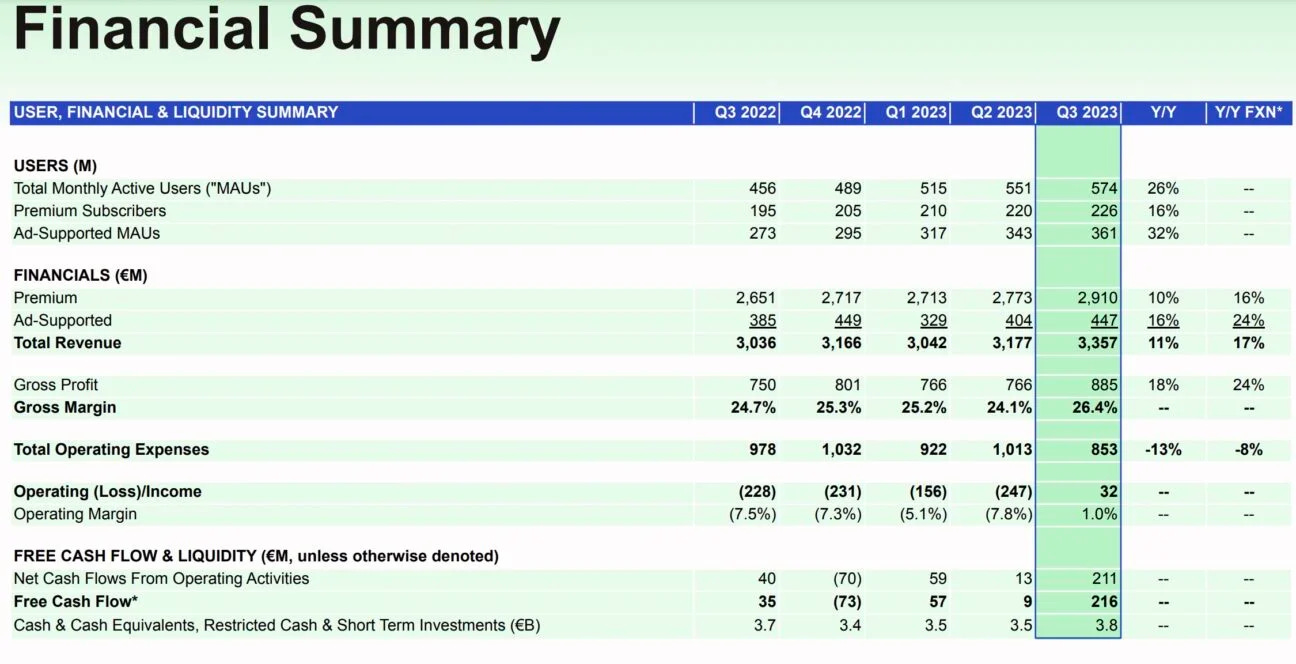

In Q3, Spotify's total number of Premium subscribers reached an impressive milestone at 226 million paying users. This marked a YoY growth of 16% and a quarterly increase of 3% (6 million), surpassing last quarter's count of 220 million (Q2 2023).

Notably, the 6 million increase exceeded the projected figures by 2 million. Spotify attributes this growth to higher-than-expected adoption in markets where price adjustments were implemented, as well as outstanding performance in premium subscriber numbers across all regions, particularly in North America and Latin America.

Monthly Active Users (MAUs)

In Q3 2023, Spotify witnessed substantial growth in its Monthly Active Users (MAUs), reaching a milestone of 574 million users. This represents a YoY increase of 26% and a quarterly surge of 4% (23 million) compared to last quarter’s(Q2 2023) report of 551 million MAUs.

Surpassing projections by 2 million, this performance marks Spotify's second-highest Q3 growth in user additions in the platform's history. Spotify attributes this growth to outstanding performance in Rest of World and Latin America, as well as ongoing efficiency improvements in performance marketing.

Premium Revenue

In Q3 2023, Spotify experienced significant growth in Premium subscribers, resulting in approximately $3.16 billion in Premium revenue, a YoY increase of 16%. This revenue surge was driven by both subscriber gains and the initial impact of price adjustments, following Spotify's decision to raise subscription prices in 53 markets including the US in July.

Ad-Supported Revenue

In Q3, Spotify's ad-supported revenue reached an impressive $486.5 million, showing a YoY growth of 24%. This growth is attributed to increased sales of impressions and consistent pricing. Combined with the revenue from premium subscriptions, Spotify achieved a total Q3 revenue of $3.65 billion, marking a noteworthy YoY increase of 17%.

Operating Expense

In a major milestone, Spotify achieved profitability by reporting an operating income of $34.82 million. The platform attributes this positive result to several factors, including the rising popularity of podcasts, growth in marketplace activity, and improved cost efficiencies throughout various revenue categories. This marks Spotify's first quarterly profit since Q1 2022.

Spotify also experienced an 8% YoY decline in operating expenses, which decreased from $1.03 billion in Q3 2022 to $902 million in Q3 2023. This reduction can be primarily attributed to a decrease in marketing expenses and personnel-related costs. Specifically, Spotify earlier implemented strategic measures like the reduction of 500 jobs in January and a further 200 jobs in June.

Next Quarter (Q4 2023) Projection

For Q4, Spotify anticipates a total of 601 million Monthly Active Users (MAUs), an increase of 27 million from Q3 2023. The platform also expects its Total Premium (paying) Subscriber base to reach 235 million, adding 9 million new subscribers compared to the previous quarter. Spotify forecasts an operating income of $39 million and targets a total revenue of $3.9 billion for Q4.

Furthermore, Spotify expresses confidence in achieving these projections as it highlights three key strategies it plans to double down on; viz:

- Improving and expanding its product offerings

- Reducing costs

- Raising subscription prices

Improving and expanding its product offerings

Spotify has introduced an audiobook service exclusively available to its Premium subscribers in the UK and Australia. This offering grants access to a library of 150,000 audiobooks, allowing users to enjoy up to 15 hours of content per month at no additional cost. The audiobook service should launch in the US soon as well.

As part of Spotify's strategy to enhance its 'value to price ratio,' expanding beyond music is crucial. The inclusion of podcasts and now audiobooks aligns with Spotify's vision of becoming a comprehensive one-stop destination for audio entertainment.

What does ‘Value-to-Price Ratio’ mean

Value-to-price ratio represents the balance between what you pay (the price) and what you get (the value) in return. It's not just about the cost, but also the quality and satisfaction you derive from the product or service. Ideally, the higher the value-to-price ratio, the better the deal because you're getting more value for your money.

While Spotify is optimistic that the audiobooks division will contribute to its 2024 results, its main focus currently lies in expanding the service to more markets. Monetization plans for audiobooks are still under consideration, especially since paying subscribers already receive 15 free hours of content monthly. Spotify, however, mentions that some audiobook enthusiasts are willing to pay for additional hours beyond the allotted 15.

However, Spotify’s move into the audiobook space has received a mixed reception from the book publishing industry. “The streaming of audiobooks competes directly with sales and is even more damaging than music streaming because books are typically only read once, while music is often streamed many times,” a statement from the Society of Authors read.

Reducing Costs

In January, Spotify decided to implement a hiring freeze and conducted a round of layoffs, resulting in a reduction of 500 jobs. This move was followed by another round of layoffs in June, amounting to 200 job cuts, as part of a restructuring effort within Spotify's podcast division. To amplify its focus on podcasts, Spotify decided to shut down its live-streaming product, Spotify Live in April.

Raising subscription prices

In July, Spotify finally increased the price of its Premium subscription from $9.99 to $10.99. It took them a while to do this because they wanted to build a big customer base and grab a larger share of the market.

Lowering the subscription price was a smart move initially, but due to inflation over the years, major labels and other music companies licensing music to Spotify stepped on their neck. Spotify had feared that increasing the price might lead to losing customers, but luckily, Spotify's Q3 report showed no negative impact.

Instead, they gained 6 million new paying subscribers in the same quarter, exceeding their expectations by 2 million. This outcome has made Spotify realize they should offer even more value, like podcasts, audiobooks, and AI technology to justify the present and future price increases.

“Price hikes are now part of the arsenal of tools we can deploy to keep growing the business, and I think you should expect us to use that when we see the appropriate dynamics,” says Daniel Ek, Spotify’s CEO.